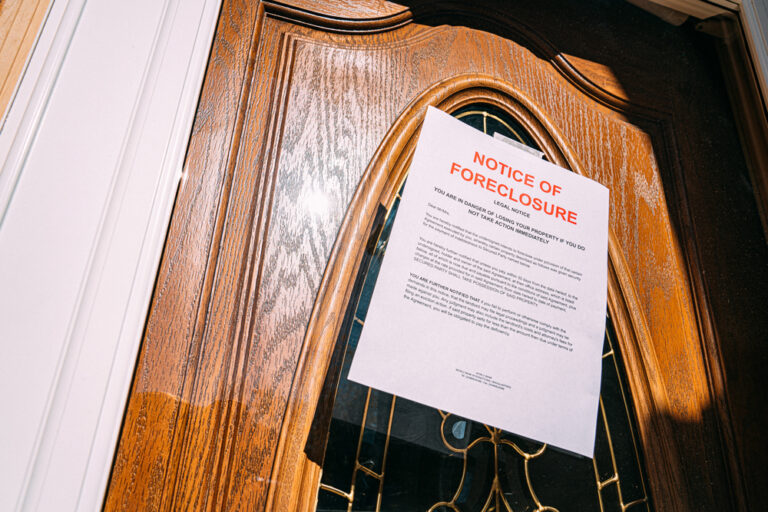

Tax Title Liens and Foreclosures

Laura Brown represents all parties in the Tax Title Lien and Foreclosure Process: Municipalities, Property Owners, Investors and other Attorneys seeking tax title expertise.

Municipal Tax Title Law

In Massachusetts, if the Property Owner does not pay the real estate taxes, the City can foreclose upon the Property and evict the Property Owner. Real estate taxes have priority over every other lien on the Property, including the bank mortgage, creditors, the IRS and the Massachusetts Department of Revenue.

When a Property Owner owes real estate taxes, the City “takes” the Property. In other words, its places a lien upon the Property. It must publish a notice in the local paper and then record an “Instrument of Taking” or “Tax Taking” at the Registry of Deeds.

At this point, this Tax Taking is just a lien on the property, like a mortgage.

If the real estate taxes are still not paid, the City has three choices:

- It can wait and collect sixteen (16%) percent interest on the lien;

- It can auction the Tax Taking Lien itself to Investors (like mortgages are sold to different banks/investors on Wall Street); or

- It can foreclose upon the Tax Taking in Land Court in Boston. If the taxes are still not paid, and no one objects, the City becomes the Owner Property. It will now be a Tax Possession. Later, the City may auction its new property or keep it.

Important Points

Tax Title Liens collect Sixteen (16%) Percent Interest. This is a Massachusetts law passed by the State Legislature. It is not controlled by the Cities.

Right of Redemption. After the Property is foreclosed upon in Land Court by either the City or the Investor, the Prior Owner has a one (1) year “Right of Redemption” to redeem the property by paying the taxes. This is NOT automatic. The Prior Owner must petition the Land Court in Boston and obtain an Order from the Judge. The City or Investor which now owns the Property may object as it may want to keep the Property. The Judge decides.

Tax Title Auctions: Dumbing It Down with Laura Brown©

Legal Terms Made Easy

Seeking professional help can save you time and money

Laura Brown is a successful business owner as well as a corporate and tax attorney. She understands what is needed to help you, your family and your business.